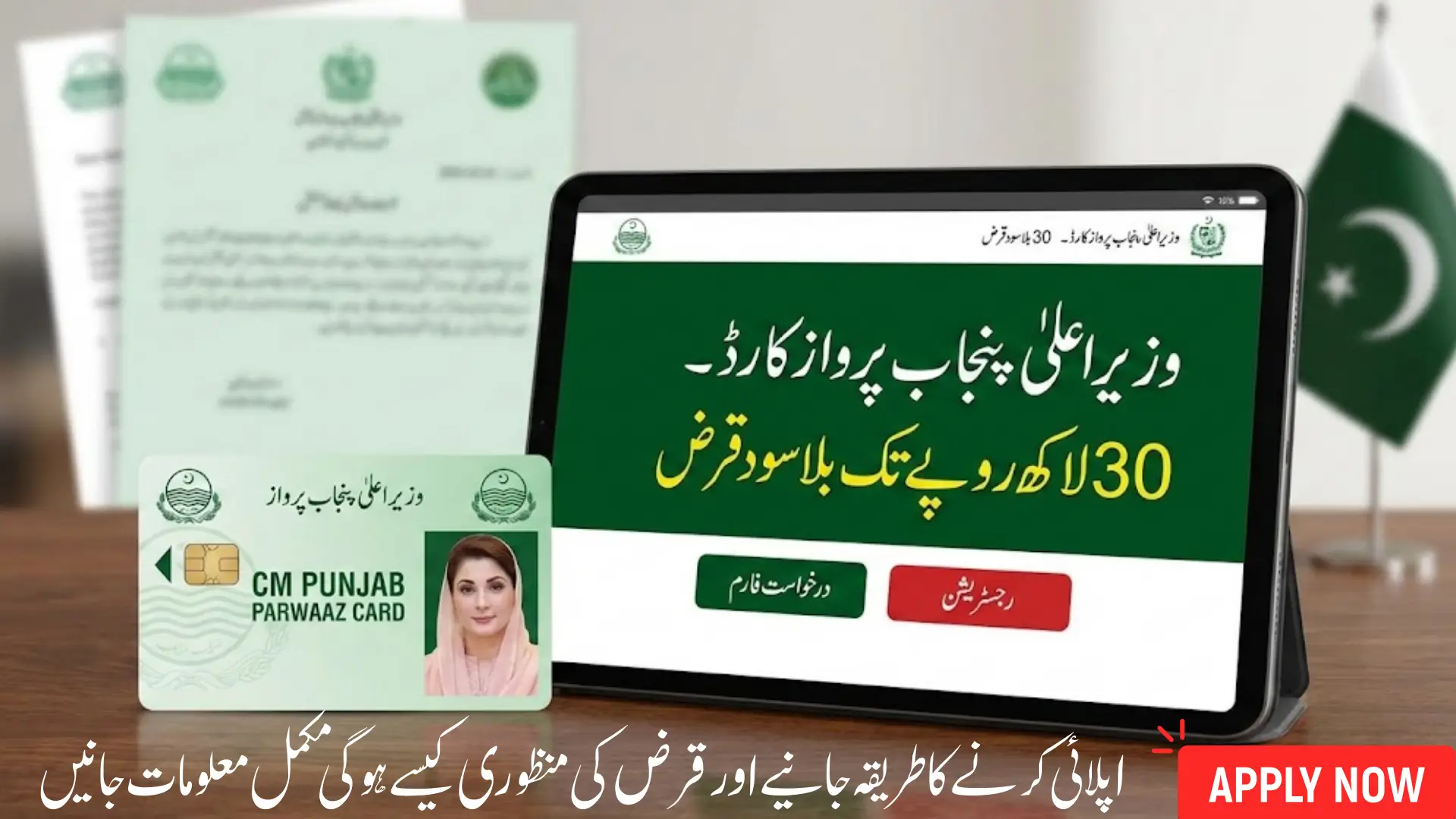

CM Punjab Parwaaz Card

CM Punjab Parwaaz Card is a government initiative designed to provide financial support to entrepreneurs, self-employed individuals, and skilled professionals in Punjab. Eligible applicants can access up to Rs 30 lakh in interest-free loans, which allows them to expand existing businesses or start new ventures. The program emphasizes economic development, entrepreneurship, and inclusive financial support.

Interest-free funding is particularly beneficial for youth, women, and small business owners who have potential but lack resources. The scheme reduces financial stress by removing interest payments, enabling applicants to focus on sustainable business growth. Evaluations are based on eligibility, business potential, and document verification to ensure transparency and fairness.

You Can Also Read: CM Parwaaz Card Registration Portal Open Know Full Process How to Apply For Loan

| Category | Details |

|---|---|

| Loan Amount | Up to Rs 30 Lakh (Interest-Free) |

| Eligibility | Punjab residents, 18+, CNIC verified, small business owners, skilled professionals |

| Required Documents | CNIC, proof of residence, business plan, financial statements, skill certificates |

| Application Method | Digital portal submission via official CM Parwaaz Card website |

| Loan Uses | Business expansion, startup costs, equipment purchase, working capital, staff training |

| Key Benefits | Interest-free, promotes entrepreneurship, youth & women empowerment, online tracking |

Eligibility Criteria and Key Requirements for Parwaaz Card

Applicants must be permanent residents of Punjab and above 18 years of age with a verified CNIC. Priority is given to small business owners, micro-entrepreneurs, and skilled professionals seeking to scale their operations. This initiative is aimed at individuals who have innovative ideas and the potential to contribute positively to the local economy.

Proper documentation is essential for approval. Applicants must provide a detailed business or project plan outlining how the loan will be utilized, expected outcomes, and sustainability. Required documents include CNIC, proof of residence, business proposals, financial statements, and relevant skill certificates or experience documents. Ensuring accuracy and completeness increases the chances of approval.

پی ایم پنجاب پرواز کارڈ ایک اہم منصوبہ ہے جو پنجاب کے نوجوانوں، خواتین، اور چھوٹے کاروباری افراد کو بغیر سود کے قرض فراہم کرنے کے لیے شروع کیا گیا ہے۔ اس اسکیم کے ذریعے اہل امیدوار 30 لاکھ روپے تک کے قرض حاصل کر سکتے ہیں، جس سے وہ اپنے کاروبار کو بڑھا سکتے ہیں یا نئی شروعات کر سکتے ہیں۔ اس اسکیم کا مقصد پنجاب میں کاروباری مواقع بڑھانا اور نوجوانوں میں خود روزگاری کو فروغ دینا ہے۔

You Can Also Read: Free Solar Panel Scheme 2026 Eligibility Required Who Can Apply Check New Criteria

Step-by-Step Application Process for Parwaaz Card Loan

The application process is digital and user-friendly. Applicants should visit the official CM Parwaaz Card portal, register using CNIC and personal details, and fill out the loan application form accurately. Once submitted, the application goes through a verification process to confirm eligibility and documentation.

Loan approval depends on the authenticity of documents, clarity of the business plan, and potential economic impact. Applicants should respond promptly to verification requests and ensure all information is accurate. Once approved, beneficiaries can access up to Rs 30 lakh interest-free funding for business growth or operational needs.

Parwaaz Card Loan Application Steps

- Visit the official CM Parwaaz Card portal

- Register with CNIC and personal details

- Complete the loan application form accurately

- Upload supporting documents (CNIC, proof of residence, business plan)

- Submit application for review and verification

- Track application status online

Essential Documents for Loan Submission

- CNIC copy and proof of Punjab residency

- Detailed business or project plan

- Financial statements or proof of business activity

- Skill certificates or relevant experience proof

- Additional documents requested by authorities

اہل افراد کے لیے ضروری ہے کہ وہ اپنی شناخت، رہائش کے ثبوت اور کاروباری منصوبہ فراہم کریں۔ قرض کی منظوری کے لیے حکومت درخواست دہندگان کے کاروباری منصوبے کی پائیداری، مالی شفافیت، اور مقامی معیشت میں ممکنہ حصہ داری کا جائزہ لیتی ہے۔ یہ طریقہ کار شفافیت اور انصاف کو یقینی بناتا ہے۔

You Can Also Read: CM Punjab Loan Scheme 2026 Apply For Interest Free 30 Lakh Loan

How to Ensure Your Loan Application Gets Approved

To maximize approval chances, applicants should:

- Submit accurate CNIC and personal information

- Present a clear and realistic business plan showing growth potential

- Provide complete and authentic supporting documents

- Respond promptly to verification requests

- Monitor the application status regularly

By following these steps, applicants can improve their chances of obtaining interest-free loans and successfully using them to expand their businesses.

Key Benefits of CM Punjab Parwaaz Card Loan

The Parwaaz Card loan comes with multiple advantages that make it a valuable tool for aspiring entrepreneurs:

- Access to interest-free funding up to Rs 30 lakh

- Encourages startups, self-employment, and business expansion

- Inclusive opportunities for youth and women entrepreneurs

- Digital application and status tracking

- Promotes sustainable economic growth and job creation

You Can Also Read: Parwaaz Card PSDF Org Pk Application Portal

How to Utilize Your Loan for Maximum Impact

The loan can be applied in various ways to strengthen business growth:

- Purchase of machinery, equipment, or inventory

- Expansion of business facilities

- Covering startup costs for new ventures

- Funding working capital or operational expenses

- Investment in staff training and skill development

Proper utilization ensures the loan delivers long-term business benefits while creating employment opportunities and contributing to the local economy.

Common Mistakes to Avoid During Application

- Submitting incomplete documents

- Providing inaccurate personal or business information

- Ignoring portal updates or verification requests

- Failing to present a clear business plan

- Delaying responses to government queries

Avoiding these mistakes increases the chances of approval and ensures a smoother loan processing experience.

You Can Also Read: Parwaz Card OEP Beneficiaries PSDF List Approved By CM Maryam Nawaz

Conclusion

CM Punjab Parwaaz Card provides a unique opportunity for eligible residents to secure up to Rs 30 lakh in interest-free loans. By following the correct application process, submitting required documents, and presenting a realistic business plan, applicants can maximize their chances of approval. This initiative not only supports business growth but also promotes entrepreneurship, youth empowerment, and inclusive economic development across Punjab.

The program’s emphasis on transparency, accessibility, and digital management ensures that applicants can efficiently track their submissions and receive timely updates. By utilizing the loan strategically, beneficiaries can strengthen their businesses, create jobs, and contribute to the province’s overall economic progress.